THE CULTURAL SEGMENTATION CASE; SHARED DECISIONS

We all make decisions with other people.

The biggest, easiest opportunity in using cultural segmentation.

When brands focus investment on demonstrating how people share joy in confronting, internalizing, and acting on new information, it’s explosive for growth.

It’s so simple, you can take it into completely different categories, and within weeks, begin sustainably outgrowing the category by 4x.

Take, for example, Women’s Shapewear and B2B Hematology:

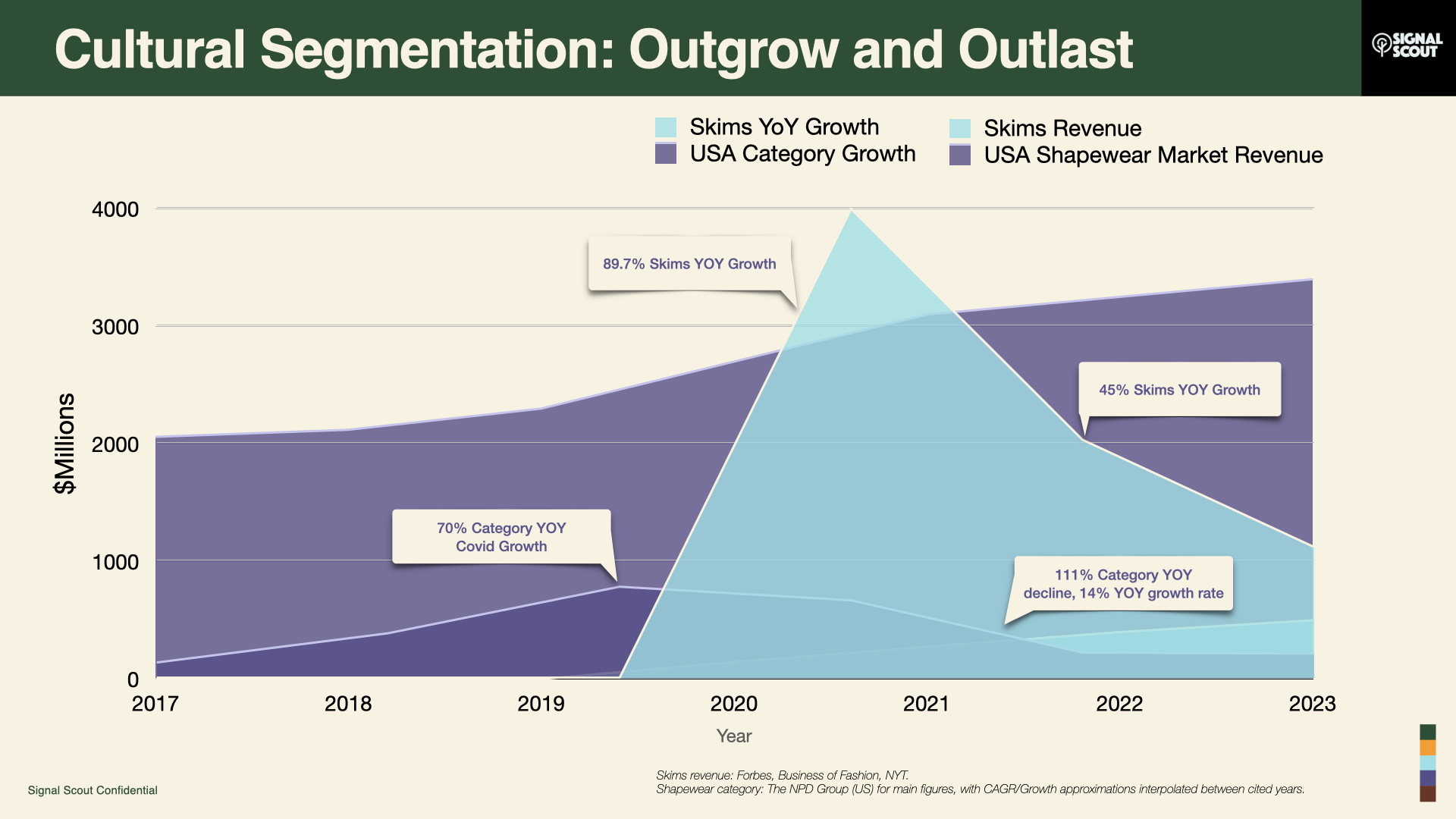

Consumer Marketing: Skims

Goal: Successfully introduce a brand in a completely saturated and established shapewear market. During COVID lockdown.

The problem: Skims is competing with around 40 established brands who have fresh cash to invest thanks to a 14% surge in US shapewear revenue.

B2B / HCP Marketing: Hemlibra

Goal: Successfully launch a new Hemophilia A medication to Hematologists.

The problem: Hemlibra is clinically less effective than everything in the category. Hemotologists are known as clinical interrogators, and defenders of their patients.

Skims: Sparked by Celebrities, fueled by shared choices

When you hear Skims, your mind goes right to Kim Kardashian and the explosive 90% growth rate in year one.

But three years in, after Covid cooled, Skims still commanded 45% growth, Ten times the category growth.

What you might not remember is the significant investment to operationalize try-on content as a targeted content optimization and product recommendation engine. This is how you use cultural segmentation insights with micro-influencers: give them the framework to create content that demonstrates social contracting and making purchase choices from sets.

What they create are instant buying occasion prompts for people who are ready to buy, in category, right now, and the social framework to persuade purchases towards Skims because the hard social contracting and cognitive work has already been done.

Hemlibra: Dominating a B2B Healthcare Category With Shared Decisions

Hemlibra is a rare disease medication made by Genentech. Because it’s a fairly unknown brand, here’s some context:

In 2017, living with, and treating, Hemophilia A starts and ends with medicines that deliver clotting factor to prevent internal bruises and bleeds. Factor Infusions are as straightforward and effective as they are painful, and multiple times weekly. Factor infusions suck.

Factor infusions are too hard for late teens living with hemophilia. They want more autonomy and control in their lives, which have become more attuned to peers. Doctors’ visits are no longer moments of shared joy; they’ve become scold sessions for people whose lives make it exceptionally hard to do these emotionally, clinically valid but difficult and painful actions.

Hemlibra does not have any clinical advantage to Factor, and Factor is every other competitor in the $600 million category. But it is easier to take more often, and a lot less painful.

In its first five years, Hemlibra used cultural segmentation instead of features and benefits to become the most-prescribed treatment for hemophilia A, treating more than 19,000 people worldwide. Hemlibra also grew the total revenue in the 2023 market to almost $9 billion, and owns almost half that revenue by year five.

Every competitor in the Factor business competes the same way: Influential doctors talking about the features and benefits of their unique factor features and benefits.

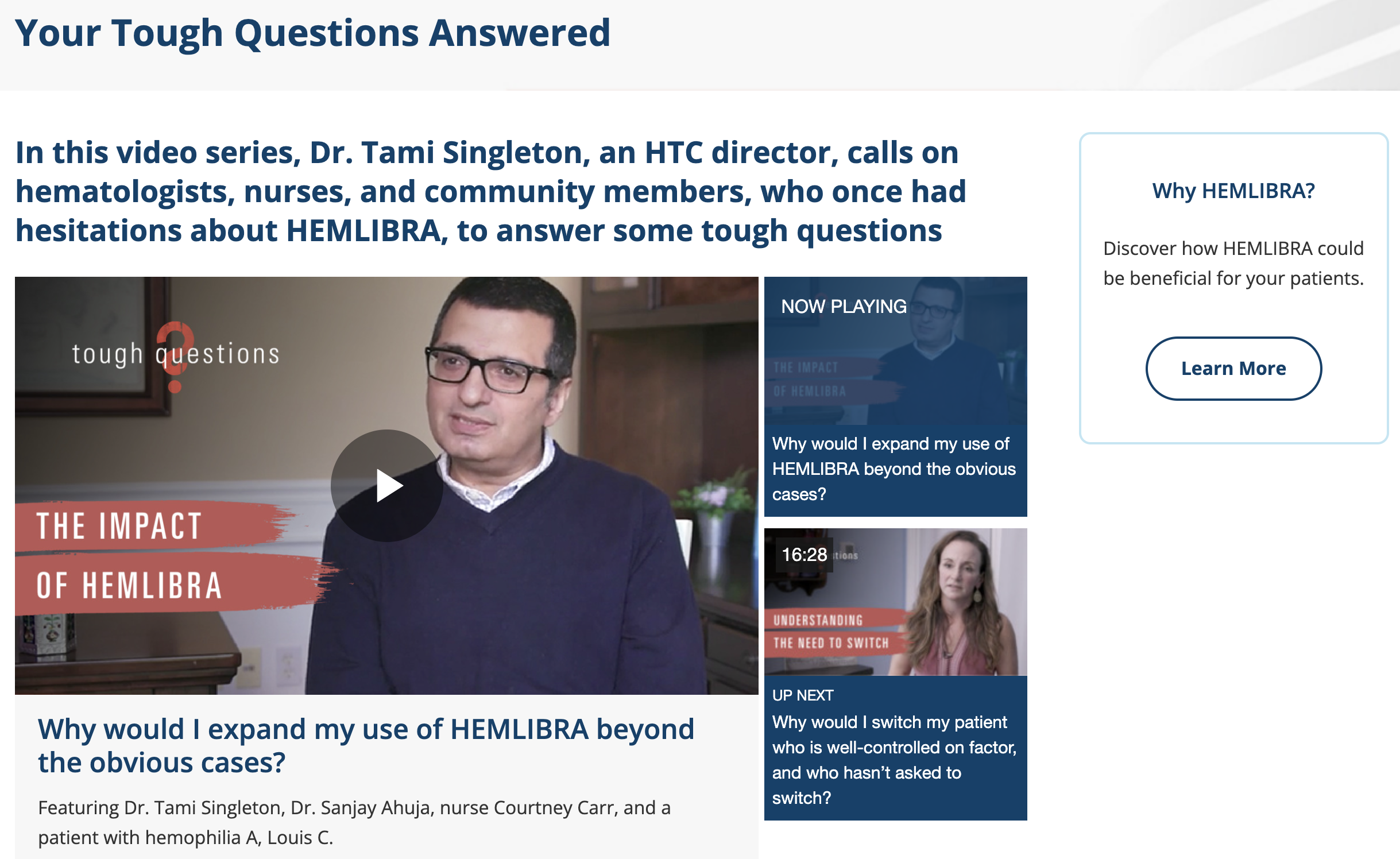

Hemlibra launched on a campaign aimed at Doctors and Patients making new decisions together in a campaign called “Doing New Things.” Instead of trying to optimize for features, benefits, and academic influencers alone, Hemlibra told the story of how people willing to try, taking new actions together.

While regulatory teams took that content offline years ago, you can still see the strategy at play online.

Here’s what one of the new competitors in the space looks like, using conventional segmentation and functional product benefit approaches to enter the market:

And here’s how Hemlibra talks to the same person, aligning to existing attitudes to set the stage for new information:

For Doctors, Hemlibra opens by aligning to Hematologists existing attitudes about being tough on data. In the video, a Hemotologist focuses on how he and his team successfully tried, and then expanded their use of Hemlibra.

Demonstrating how people try, and how trying together builds shared bonds as they become proficient isn’t new. But Skims and Hemlibra both do a great job of applying that idea to digital sequences, and sparking outsized, sustainable growth from that basic human truth.